In former article, I have tried to frame the context of energy transition (https://hama-co.net/2024/04/06/energy-transition-what-are-the-narratives/). At the end, I pointed to some narratives that frame decision making.

· Energy transition: The narratives

o The energy economy is in the inflection point.

o A new economy is emerging. It creates a lot of opportunities that encompass several risks

o High geographical and market concentration will create bottlenecks and make the value chain vulnerable

o Lead time is a fundamental component of this transition, it will make the other components especially demand and supply to oscillate

o Before this new economy reach maturity and a minimum of stability to help make a decision, new approaches will be needed and new believes need to be built.

o Participating in the emerging new energy economy needs a systemic approach where the first step is the make the building blocks of its own ecosystem. This ecosystem needs to be the corner stone of any strategy and partnership.

o Resilience and sustainability of any strategy needs a solid governance system based on a flexible decision-making tool

o Resiliency and sustainability need to build local ecosystems, the corner stone of developing and implementing strategies

In every mature market the law of supply and demand in the most important vector. In the immature market, Supply and demand are consequence of several preconditions. These preconditions are the critical areas to watch (Fig. 1). Investors need to pay attention to in order to develop a competitive advantage.

In this article, further thinking is undergone to help decision- making based on system’s thinking and navigating complexity. The specificity of energy transition is all conditions are changing and actors do not necessarily know about all conditions.

Any initiative should be built at several logical levels. The first one is how to set up or reinforce the local ecosystem. The other is to build on local assets and strengths. This means all initiatives should have the best level of granularity. level that allows better decision making. As we all know, the evil is in the detail.

Fig 1: Energy transition: the performance domains

1. Build on relevant Assets

First of all, any actor needs to position himself in the value chains and identify what are the asset that he owned. Critical minerals potential to build on and attract investors. build partnership to enlarge own’s influence on the value chain. Large area for solar energy or sea wind to produce green energy. Potential to extract green hydrogen could be a corner stone to develop a coalition. Those local assets are difficult to “delocalize” and there is a high demand on them. Lesson from covid experience is, assets are better valuated where they are located. Leveraging on them is one of the main performance domains to address.

2. Build competencies and skills

Competencies and skills constitute the other important performance domain. Any actor needs to build and build on. The technology uncertainty is high and R&D effort is increasing everywhere. Whose technology wins will have the most important share of the market.

Several technology models are undergoing. Take the example of battery models. Cathode chemistry play an important role in the batterie performance. At least three categories of EV cathodes are widely used. They are actually competing: Lithium nickel manganese cobalt aluminum oxide (NMC), Lithium nickel cobalt aluminum oxide (NCA) and Lithium iron phosphate (LFP) . there is also solid-state battery. It is one of the promising advancements in EV batteries technology. Which model will win? Difficult to answer. The only way to save the share of opportunity is to be engaged in developing competencies and skill in the area. To track any change about the fundamental parameters. The energy density, the cost and the availability of materials.

The same is said about producing green hydrogen technology. H2 generation technologies from renewable resources such as biomass and water are considered and researches are undergoing now to optimize the process. Here are some key trends and technologies: Advanced Electrolysis Methods, Improved Catalysts.

To produce, transport and store green hydrogen is attracting interesting researches.

3. Build on lessons from the market

Any investor needs to accumulate learning from market. Industries that consume the energy need to tracked and monitored continuously. Take for the instance the EV market. How sales of electrical vehicles are changing? what are the most important trends and what are the deep reason behind them? where the investment flow is going? Is there any geopolitical decision or regulation that could impact the market?

How about the manufacturing industries? are they consuming more green energy? is there any trends or reason behind them. In each industry, what is the share of green energy consumed.

According to IEA (World Energy Outlook 2023), the manufacturing sectors heavily consuming green energy are primarily those involved in producing electric vehicles, solar PV modules, and batteries. The steel, cement, and chemical industries are also pivoting towards green energy sources as part of broader efforts to reduce their carbon footprints.

In 2023, global investment in clean energy technologies reached approximately $1.8 trillion, marking a 17% increase from the previous year​ (BloombergNEF’s : Energy Transition Investment Trends 2024)​. However, the distribution of this investment is heavily skewed towards advanced economies and China. More than 90% of the increase in clean energy investment between 2021 and 2023 occurred in advanced economies and China​​. Any investor needs to build on those trends and track any change or any shift from what was established.

To do so, actors have to build a network allowing feedback from mead stream and downstream actors. As any actor is a part of an ecosystem as he will learn a lot.

4. Build Infrastructure and distribution capacity

Getting the power where it needs to go is another story. Renewable energy sources are expected to provide between 45% and 50% of global power generation by 2030 and could rise to 65-85% by 2050. The integration of these high levels of renewable energy presents challenges in grid stability. It requires significant upgrades to the existing infrastructure​ (McKinsey & Company : Global Energy Perspective 2023 report)​. So the global length of power transmission lines is expected to increase by approximately 185% and distribution lines by almost 165% from 2021 to 2050. ​ (IEA: Energy Technology Perspectives 2023 report)​.

Lack of sufficient infrastructure will jeopardize the access to energy and not exploiting the whole potential of this mega opportunity. However, the investment required to support a sustainable and resilient energy in future is huge on. Coalition and partnership is a must.

5. Build Partnership and coalition

Exploiting this mega opportunity, requires the integration of skills and capabilities residing in a wide variety of companies. No one firm or even country possesses all the required resources to bring the green energy to the final client. Every actor needs to focus on its core competencies and assets and build coalition with complementary partners. Synergies will increase the share of influence of each one. This coalition may also be useful in co-opting potential competitors and thereby reducing the threat of future rivalry (Gary Hamel&C.K PRAHALAD: competing for the future).

In this domain we have to learn a lot from Chinese companies. Below are some examples of partnership in the domain of critical minerals valuation and infrastructure development.

Chinese companies have actively invested in lithium mining in Zimbabwe, part of a broader initiative to secure lithium supplies essential for battery production. These investments are often part of larger agreements involving infrastructure development in exchange for mineral rights. (https://www.usip.org/publications/2023/06/challenging-chinas-grip-critical-minerals-can-be-boon-africas-future​​)

China plays a dominant role in the DRC, home to a significant portion of the world’s cobalt and copper resources. Chinese firms hold substantial stakes in the mining operations which are crucial for the production of electric batteries​.

Chinese companies have become vital partners in the Gulf States’ energy transitions, focusing on technologies like electric vehicles, energy storage, hydrogen, and carbon capture. These partnerships leverage China’s technological prowess and the Gulf States’ strategic goals of decarbonizing their energy sectors​.(https://www.csis.org/analysis/chinas-essential-role-gulf-states-energy-transitions)​.

China plays a significant role in developing renewable energy manufacturing capacity across Africa. This involves strategic partnerships aimed at establishing and expanding manufacturing facilities for renewable energy technologies, which is crucial for Africa’s growth and its position as a potential global manufacturing hub​ (Sustainable Energy for All: Africa Renewable Energy Manufacturing )​.

6. Governance: Policies incentives setting standards and regulations

“An effective governance framework is especially important in environments that are highly complex or uncertain, when it is necessary to respond rapidly to outcomes and information that become available during the course of the program. The Governance Framework performance domain makes it possible to clarify the organization’s vision, facilitate alignment of the program with organizational strategy, and enable the periodic balancing of program demands with current organizational capabilities. Governance participants are able to monitor and, as necessary, authorize or limit changes to the activities performed as part of a program.” (Standard for Program Management, Fifth edition, PMI www.pmi.org)

Fig 2: Energy transition: The Governance system

An efficient governance system is important in environments that are highly uncertain and complex when it is necessary to respond rapidly to the changes. A “good” decision-making has to be made quickly. A “good “decision-making depends on the structure of the system to be set up. It has to be as diversified as possible to ensure several perspectives at once. So each of the performance domains has to be “represented” in decision-making. Information from each domain described above needs to be collected continuously. A solid Information Management System is highly required. The decision-making entity will have the necessary information available. But it will need also the power to decide, so setting up phase’s gates review is then required. (Fig.) How to decide is described below.

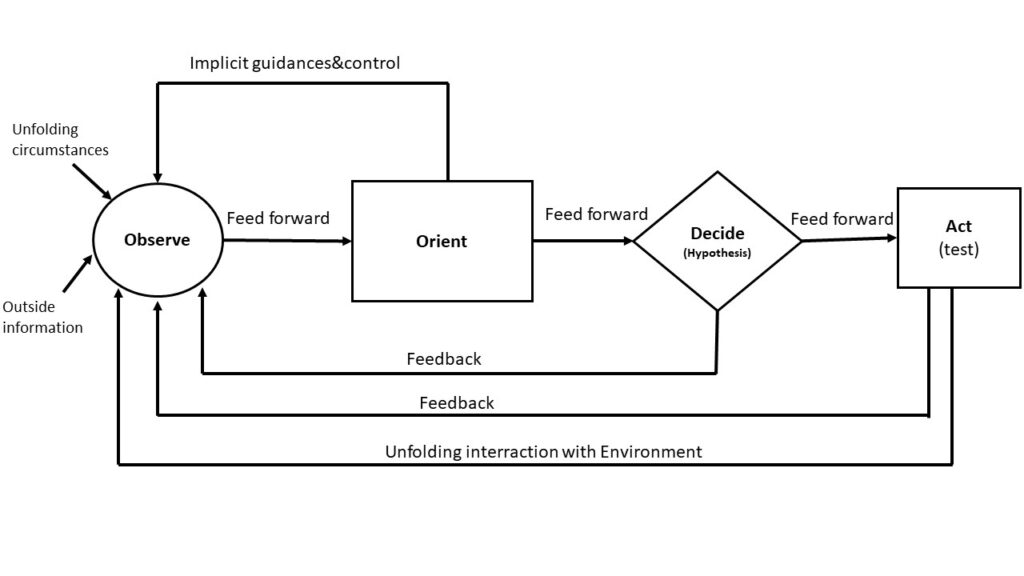

Governance is coupled with the initiative peace. On one hand it helps to look where is still the opportunity to exploit? on the other, is it necessary to stop and not to go further, far from the system could absorb? Information needs to be collected, analyzed, synthetized, interpreted and make the decision after. Ancient partners could be future competitive, ancient competitive could be future partners. To do so, actors need a tool and framework to decide. One decision that will be relevant for a long time will not exist because the system in not yet mature and trends are still be generated. Not knowing all of the conditions, a decision needs to be made based on a quickly developed hypothesis and this process revert back to the observe stage. I propose de use the OODA loop (Fig. 3).

Fig 3: Energy transition: How to decide

( OODA (OBSERVE, ORIENT, DECIDE ACT).

After collecting the available information relating to all the six domains described above, decision needs to be made even if we are not knowing all of the conditions. A decision needs to be made based on some information and some quickly developed hypothesis. During the Observe step, Actors need to assess the environment, one’s place in it and the interaction of the two”. SWOT analysis could be of a great help. Environment factors could be R&D trends, then investment flows, partnership building and of course any new geopolitical decision or new law or new set up standard. The orientation stage involves the analysis and synthesis of all information resulted from the observation stage. The new decision of China not to export REEs is a political decision that will influence the cost and the availability of these materials and any business case of related initiatives. Besides, it will boost REEs mining exploration projects in the world. So, decision making step will follow Observe and Orient Steps. When deciding, Acting should follow. Any delay could make the decision irrelevant. In system thinking, delay could create phase shift and oscillation which will further complicate decision making. After each step, feedback should be used. Returning back to the changing environment to collect new information, reinterpret them, develop new hypothesis and decide will help a lot. In this way the decision-making system will be flexible efficient and the initiatives will be resilient to change.