Auteur: Abderrazak HAMZAOUI

Hamzaoui@hama-co-net

- Introduction

All energy transitions were lead and initiated by Human being. Technology lwas always the most important driver. The threat of climate change is the most important driver now. Human being led all the past transitions but the current one is undergone by him. The most important questions at tis time are: how could we profit from it? How could we mitigate its risks and navigate safely on its waves.

A new economic system is setting up; the conventional one needs to disappear. As the Italian philosopher Antonio Gramsci said: The old world is dying, and the new one struggles to be born: now is the time of monsters”. How to tame its monsters? Actors needs to adopt systemic approach.

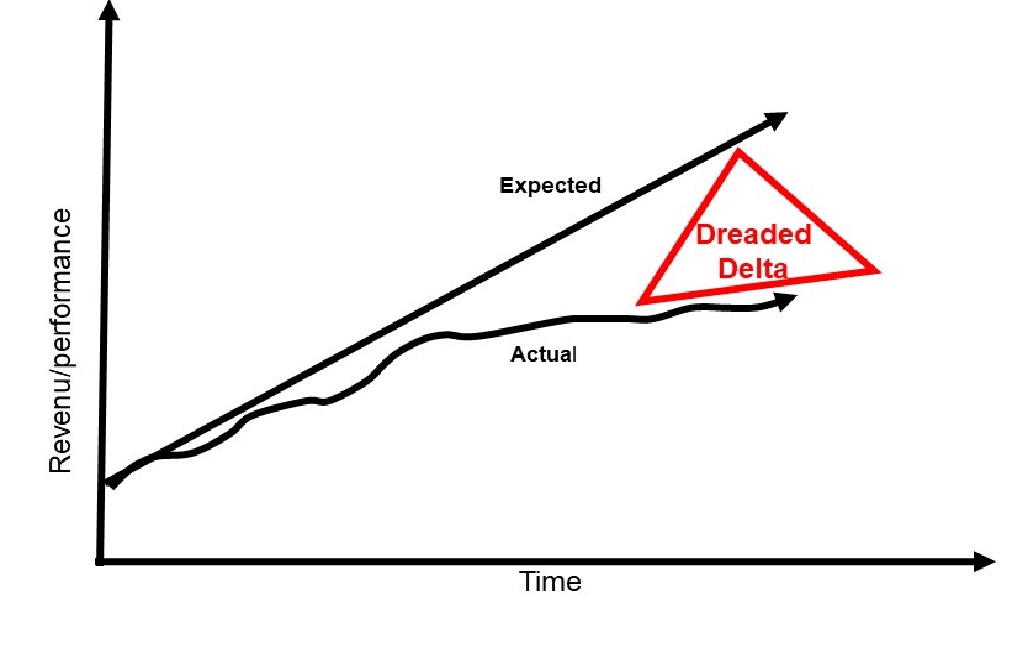

To continue adopting past tools and means is going straight to trap t of the incrementalism cycle. Productivity and revenue will decrease and will never reach what was planned. At the company level this what we call the dreaded delta (Fig.1).

To get out of the dreaded delta need to remove oneself from the past thinking tools and believes. Think about the forest without forgetting the tree.

The dreaded delta is a sign of a new system is emerging. We are living un inflection point. As Andy grove said: “The point in the life of a business (or an industry) when its fundamentals are about to change. The change can mean an Opportunity to rise to new heights. But it may just as likely signal the beginning of the end”. As this inflexion point is risky, it encompasses a lot of opportunities. (Fig . 2).

The bright face of the inflection point is as important as its risks. It encompasses a Potential competitive advantage building for the beginners. It needs insight, an unprecedented shift of mindset. An attention to weak signals and new believes. The major actors are starting to formulate. Otherwise sticking to conventional business means going straight to net failure.

The most important decisions need to be made based on a quickly developed hypotheses. Moreover, emergent change is reflective of decisions. Management’s responsibility is to identify patterns from these decisions. Their change in order to make sense of the whole system. In these articles, we try to help put the corner stone of decision-making system. It allows actors to navigate the complexity of this inflection point.

In the first part, we will prepare the framework by clarifying the present state. Point out to what are the most important trends. In the next article we will propose a decision-making framework. A frame work that will help the resilience and sustainability of any initiative.

Fig . 1 : The dreaded delta

Source: R. E JHNSON et Al. The power of strategy innovation, 2003

Fig .2: The inflection point

Source: Andy Grove: Only the Paranoid Survive: How to Exploit the Crisis Points That Challenge Every Company and Career1996

let’s make the frame of this transition itself.

- Energy transition: the present state

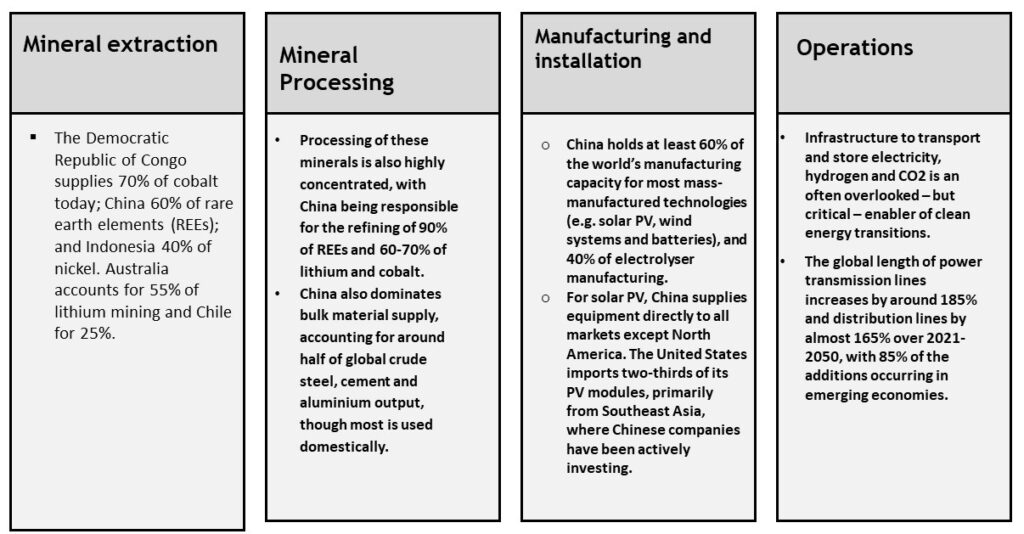

The Energy value chain concentration

Source: IEA: Energy technology perspectives 2023

What we notice from above is striking. At the four steps of the value chain, there is a concentration of assets in the hands of few actors. This put the whole chain vulnerable and would create botherless at any time.

All the countries are making engagement and investing in renewable energy economy. They plan to profit from these mega-opportunities. The door is still open for the beginners and new entrants.

- Energy transition: the initiatives

According to IEA Energy technology perspectives 2023 report, in the Net Zero Emissions by 2050 (NZE) Scenario, Global production of electric cars increases six-fold by 2030; electricity demand increases by 25%. Clean technology manufacturing capacity would meet the needs for 2030 for solar PV modules and approach that required for EV batteries, but would fall short in other areas, leaving gaps of 40% for electrolysers and 60% for heat pumps. USD 1.2 trillion of cumulative investment would be required to bring enough capacity. Requirements for 2030, with deficits of up to 35% for lithium mining and 60% for nickel sulfate production.

This would create from 33 to 70 million jobs over 2021-2030.

Manufacturing a typical-size electric car requires five times as much of materials (critical materials like copper, lithium, cobalt and nickel) as a regular car. However, opening mines or deploying clean energy infrastructure can take more than a decade. Building a factory or ramping up operations for mass-manufactured technologies requires around 1-3 years. Shortages in expanding clean energy industries are already creating bottlenecks. The major constraint is no longer financial resources but other resources like critical minerals, sources of many vulnerabilities.

Mining capacity for critical minerals needs to expand swiftly to get on track with net zero goals but Lead times for new mines are long and uncertain. Capacity to process these minerals into usable materials must also expand considerably, Conventional bulk material production capacity is emissions-intensive and very difficult to decarbonize. The current expansion plans point to continued dominance by China. So even if expansion plans are initiates, vulnerability is still there.

When it comes to technology manufacturing and installation, Today’s announced plans to manufacture solar photovoltaic (PV) modules, if fully realized, would be sufficient to meet 2030. However, expansion plans fall short for other clean energy technologies. Announced EV battery manufacturing projects, mostly in China, could boost production capacity sixfold by 2030 and meet over 80% of the needs in the NZE Scenario. Manufacturing of wind components would only grow by 5-10% (onshore) and 20-55% (offshore) by 2030, compared with a quadrupling of wind turbine deployment in the NZE Scenario. Electrolyser manufacturing capacity would rise almost tenfold from today’s level to more than 100 gigawatt (GW) by 2030, around half of NZE Scenario requirements.

Today, around 33 million people are working in clean energy. By 2030, an additional 8 million workers will be needed to manufacture electric vehicles and their batteries, An additional 4 million workers will be needed to install (75%) and manufacture (25%) solar PV, wind and heat pump systems. Capabilities and skills are the other source of constraints and value chain vulnerability.

Supportive industrial policies were initiated. tTrade policies largely explain China’s globally dominant manufacturing base. As US Inflation , Reduction Act, the REPowerEU plan, Japan’s Green Transformation initiative and India’s Production Linked Incentive scheme. These initiatives will accelerate transitions plans but will put the developing countries on difficult competing situation. This would stress a need for more partnership building.

- Energy transition: The gap

The gap is large is in the Enabling infrastructure area. Infrastructure to transport and store electricity, hydrogen and CO2 is an often overlooked – but critical – enabler of clean energy transitions. The global length of power transmission lines increases by around 185% and distribution lines by almost 165% over 2021-2050, with 85% of the additions occurring in emerging economies. Trade in low-emission hydrogen, which is almost non-existent today, covers more than 20% of global merchant hydrogen demand by 2030. Annual CO2 storage injection capacity jumps from around 42 million tonnes (Mt) of CO2 today to around 1.2 gigatonnes (Gt) by 2030. Such rapid growth would place considerable demands on supply chains. Another source of constraint that will create bottlenecks in several geographical areas.

Global annual investments in low-emission hydrogen and hydrogen-derived fuel transport, including in pipelines, storage facilities, terminals and refuelling stations reach more than USD 50 billion over the latter half of this decade in the NZE Scenario. With increasing demand for hydrogen and hydrogen-derived fuels over time, infrastructure investments reach more than USD 80 billion in 2041-2050. CO2 infrastructure deployment also accelerates in the NZE Scenario, but it is constrained by the required lead times for developing CO2 storage capacity.

Building energy infrastructure today can take more than a decade While construction is in most cases a relatively efficient process, taking two to four years, planning and permitting can often cause delays and create bottlenecks, with the process taking two to seven years, depending on the jurisdiction and infrastructure type. Lead times for infrastructure projects are usually much longer than for the facilities that connect to them. As we learn in systemic approach, lead time creates oscillation between supply and demand. Business case would be sound before the inception of any initiative. Those oscillations will jeopardize projects viability.

- Energy transition: The narratives

- The energy economy is in the inflection point.

- A new economy is emerging. It creates a lot of opportunities that encompass several risks.

- High geographical and market concentration will create bottlenecks and make the value chain vulnerable

- Lead time is a fundamental component of this transition, it will make the other components especially demand and supply to oscillate

- Before this new economy reach maturity and a minimum of stability to help make a decision, new approaches will be needed and new believes need to be built.

- Participating in the emerging new energy economy needs a systemic approach where the first step is the make the building blocks of its own ecosystem. This ecosystem needs to be the corner stone of any strategy and partnership.

- Resilience and sustainability of any strategy needs a solid governance system based on a flexible decision-making toolResiliency and sustainability need to build local ecosystems, the corner stone of developing and implementing strategies

- In every mature market there is some laws that are used, one of them is supply and demand. Supply and demand are consequences of a lot of preconditions, context and decision of the main actors. These preconditions should be the critical areas where any actors need to pay attention to and perform in order to develop a competitive advantage.

Any initiative should be built at several logical levels. The first level is how to build or reinforce the local ecosystem, and the other level is to build on local assets and strengths. This means that the initiative should have the optimum granularity level that allows better decision making. As we all know, the evil is in the detail.

The next article will be about a flexible making decision system. It will include also the critical area that should be taken into account. Any initiative has to be resilient. It must ensure the realization and sustainability of its expected benefits.

[…] former article, I have tried to frame the context of energy transition (https://hama-co.net/2024/04/06/energy-transition-what-are-the-narratives/). At the end, I pointed to some narratives that frame decision […]